August 9, 2025 - August 10, 2025

Serving the Professional Jewelry Appraiser with Pride™

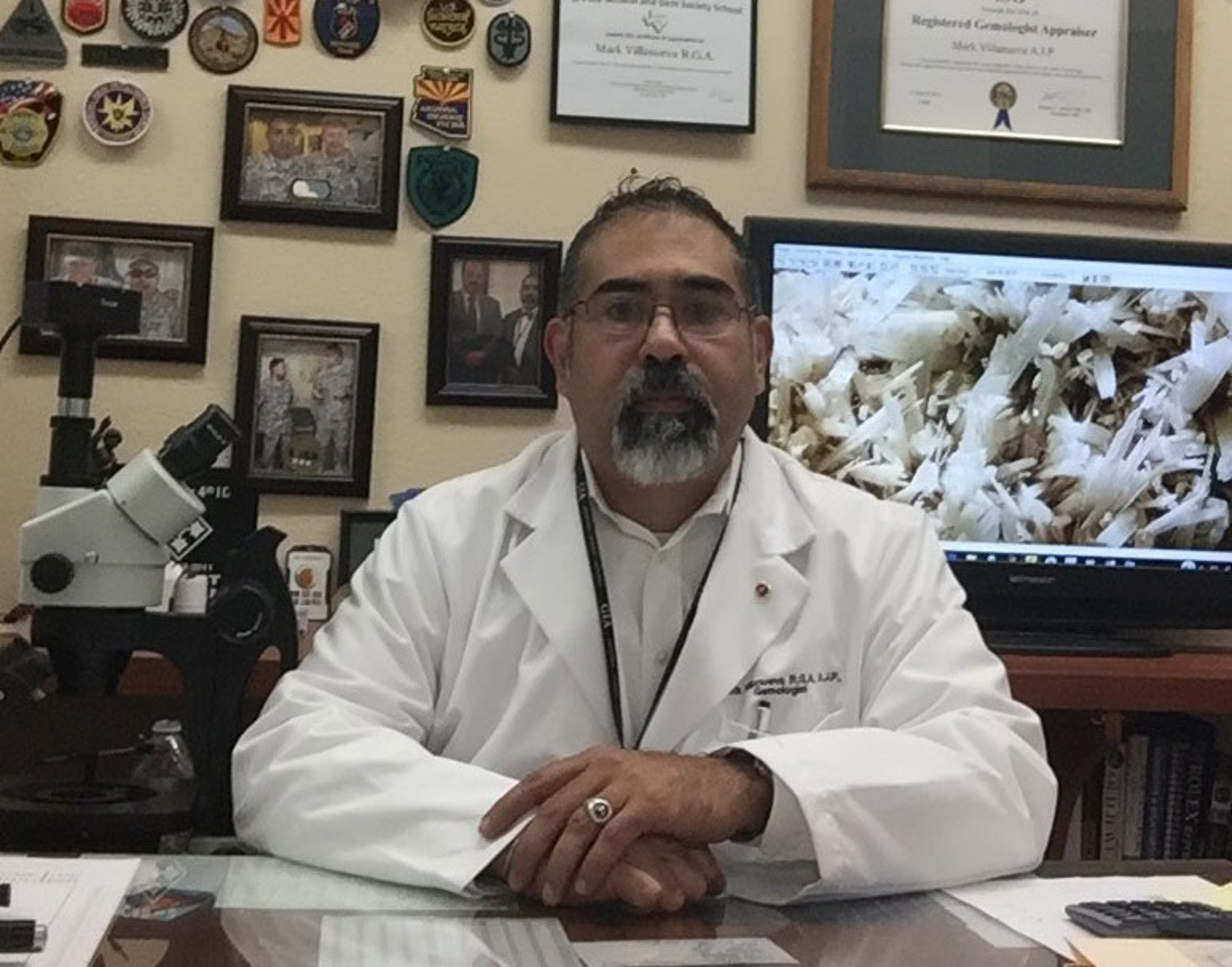

Since 1981, The National Association of Jewelry Appraisers is the only appraisal association in the United States that devotes itself solely to the appraisal of fine gems, jewelry, and timepieces.